Homes this year have transformed into playgrounds, classrooms, home gyms and offices. As a home owner, to address those needs, you are likely increasing your energy usage. Energy or “green” mortgages can offer home owners and home buyers opportunities to purchase homes that utilize energy-efficient technologies through mortgages that permit higher debt-to-income ratio requirements.

Higher home energy costs can translate into higher utility bills. Freddie Mac recently reported that “household electrical usage in late March was about 22 percent higher than in 2019,” at the onset of stay-at-home orders, with midday consumption (between 10 a.m. to 3 p.m.) rising approximately 35 percent. Depending on local utility costs, this would equate to an approximate $25 increase in monthly utility bills in the month of April.

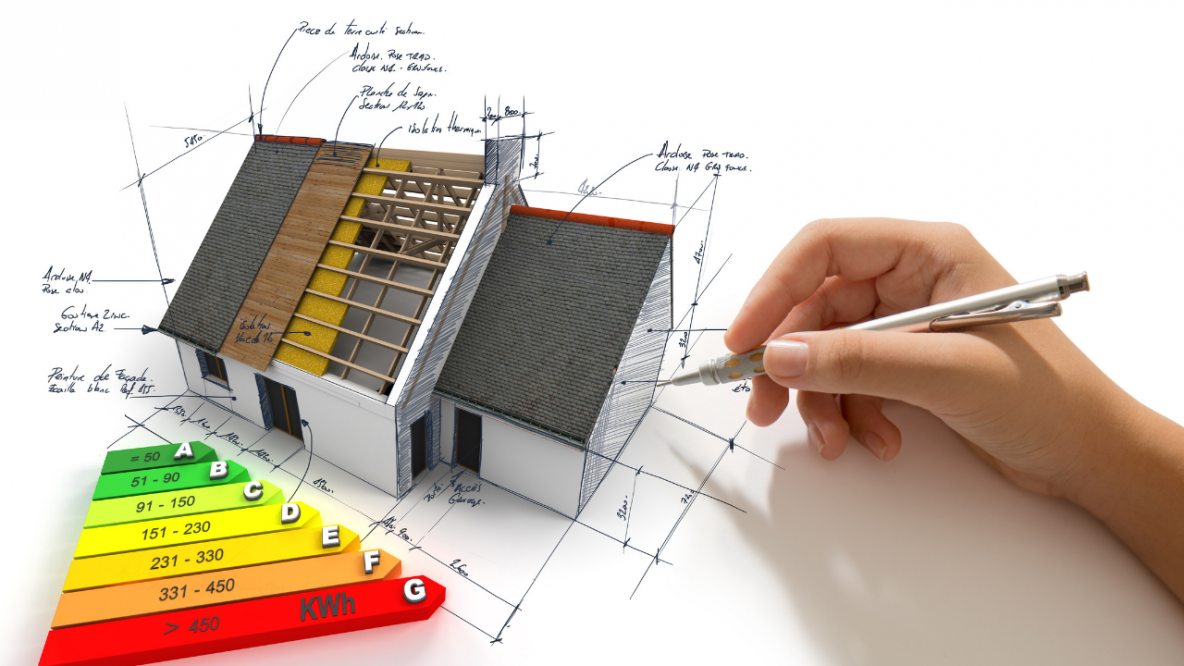

To help home owners increase the energy efficiency in their home, there are two types of energy-efficient mortgages available for home owners and home buyers. An “energy efficient” mortgage gives home buyers a credit for existing energy-efficient upgrades, usually in the form of higher debt-to-income ratio limits or a lower interest rate due to lower expected utility costs. Alternatively, an “energy improvement” mortgage can be used to finance energy improvements to existing homes to increase their energy efficiency. Energy mortgages are available through federally insured mortgage programs such as the Federal Housing Administration and the Veterans Administration, and also through conventional secondary mortgage markets like Fannie Mae and Freddie Mac.

To reduce energy consumption and utility bills, home owners can consider upgrades such as energy-efficient appliances, heating, ventilation or air conditioning (HVAC) units, windows and doors, as well as the addition of air sealing, insulation, solar panels or geothermal heating. Not only can such energy-efficient upgrades help decrease monthly utility costs, but a study released by Freddie Mac last year has also shown that such features and green-building certifications can increase a home’s market value.

For more information, including specific questions to ask your home builder, visit homeperformancecounts.info. Home Performance Counts is a joint initiative between the National Association of Home Builders (NAHB) and the National Association of REALTORS® (NAR) to help home owners better understand the rapidly growing high-performance home marketplace.

To find a professional who can help you, contact stephanie@fortsmithhomebuilders.com.

Justin Green

President, Greater Fort Smith Association of Home Builders